To do that, you need to keep track of your finances and understand what your expenses are, and what your cash flow is. An estimated 60% of tax filers in the U.S. use a professional tax preparer. Lack of time and an increasingly complicated tax code are leading more and more people to seek outside help in preparing their tax returns. Franchisors and franchisees need to understand franchise accounting basics. A mistake in transaction records could result in the franchisee or the franchisor being paid incorrectly.

Royalty Fee Collection:

By using a tax professional, like a franchise, individuals can provide themselves a buffer between them and the IRS in case an audit occurs. In franchise accounting, the franchisee owns an individual franchise location. They operate the franchise under the guidelines the franchisor sets. Buying a franchise can help you grow your business faster because of the recognizable brand. When it comes to franchise accounting, sticking to a budget is crucial for maintaining good cash flow.

- It helps identify any gaps in cash flow and allows for better decision-making to address any potential shortfalls.

- Get started with Xendoo today with our 30-day money-back guarantee.

- North One has designed business banking services for small business owners across America.

- Sometimes, the fee is a percentage of the net sales or a flat dollar amount.

- They can access the software program from anywhere with an Internet connection so that both parties have instant access to financial records.

Master Franchise Accounting

These metrics often align with the franchise’s business model, which could be low-margin and high-volume, demanding rigorous sales targets. Franchise owners play a crucial role in conducting commerce according to the terms and conditions set by the franchisor. They must adhere to the guidelines and standards set by the franchisor, which can include everything from pricing strategies to employee training protocols. This ensures consistency and uniformity across all franchise locations, strengthening the overall brand image. We’ll manage your books, taxes and finances so you can focus on growing your franchise business. Partner with an expert team of franchise centric bookkeepers, accountants, and CPAs.

Financial reporting is the process of preparing and presenting financial information to stakeholders. This includes the income statement, balance sheet, and cash flow statement. Financial reporting is important for the franchise owner, as it provides a snapshot of the financial health of the business. Tax franchises can help these individuals and businesses sort through the complex tax filing process and provide a measure of peace-of-mind to their customers. When an individual signs a tax return, it means he or she is on the hook for any questions the government might have – even years down the road.

Having a clear budget is the best method to assure a healthy cash flow.

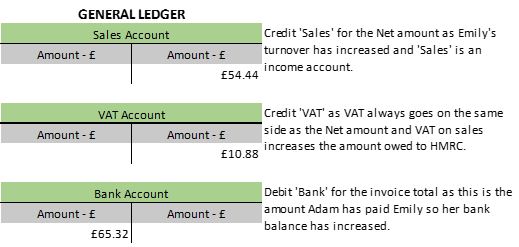

Franchise accounting requires proper record-keeping and financial management to ensure compliance with both the franchisor’s guidelines and any legal and regulatory requirements. In summary, franchises have special accounting needs related to how a general ledger works with double-entry accounting along with examples revenue reporting, royalty fee collection, marketing fee payments, and routine financial reporting. By addressing these specific requirements, franchise businesses can maintain accurate financial records, meet contractual obligations, and ensure the successful operation of their franchise locations. Franchise accounting plays a crucial role in the financial management of a franchise business, ensuring transparency and accuracy in the reporting of financial data. Franchise owners need to have a clear understanding of their financial statements, expenses, and revenue to make informed business decisions.

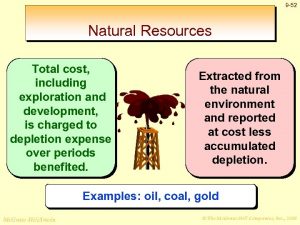

The franchise profiles on our website will present you with a basic range for the initial investment or minimum cash required to open a franchise. But when it comes to finding out the details of an initial investment, the franchise disclosure document is the best place to look. Franchisors offer itemized estimates in their franchise disclosure document (FDD) based upon their experience establishing, and in some cases operating, units. The same amount must be deducted each year, so the fee needs to be divided evenly. If your agreement lasts less than 15 years, your amortization schedule for the fee will just last the contract’s length. Xendoo works with fundamentals of financial accounting emerging and mature franchises ranging from gyms, to trades specialists and everything in between.

Keep in mind, though, many opportunities in this field aren’t technically franchises.

Before paying the fee, the franchisee needs to project how much business capital they will need. When you choose to work with Guardian CPA Group, you’re not just hiring an accounting firm; you’re partnering with a member-based organization invested in your success. With a unique blend of AI technology and a seasoned staff, we give you the tools and expertise you need to focus on what matters most—your business.

Using a single software provider for accounting and payroll for franchises could also lead to a volume discount for these services. Even if you decide to outsource your books to an accountant, payroll for accountants could drastically decrease the financial burden on your overhead. As a franchise owner, you can run your own business without the risk of starting a brand new company. Like any business, you take on the many responsibilities of day-to-day operations, including some basic accounting tasks. Though franchise accounting is similar to accounting for other types of businesses, it includes a few extra steps.

Managing the finances of an area multi step income statement development franchise can be challenging, as the franchisee has to coordinate the accounting process across multiple locations. However, this model provides a significant opportunity for growth, as the franchisee can expand their business operations within a specific territory. The franchisor can also provide support and guidance in managing the finances of multiple locations, ensuring consistency and accuracy in financial reporting. A balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a particular time. It provides insights on a franchise business’s financial position and helps to track changes in assets and liabilities over time. It’s essential to maintain accurate balance sheet records to evaluate the franchise’s financial health.

Leave a Reply